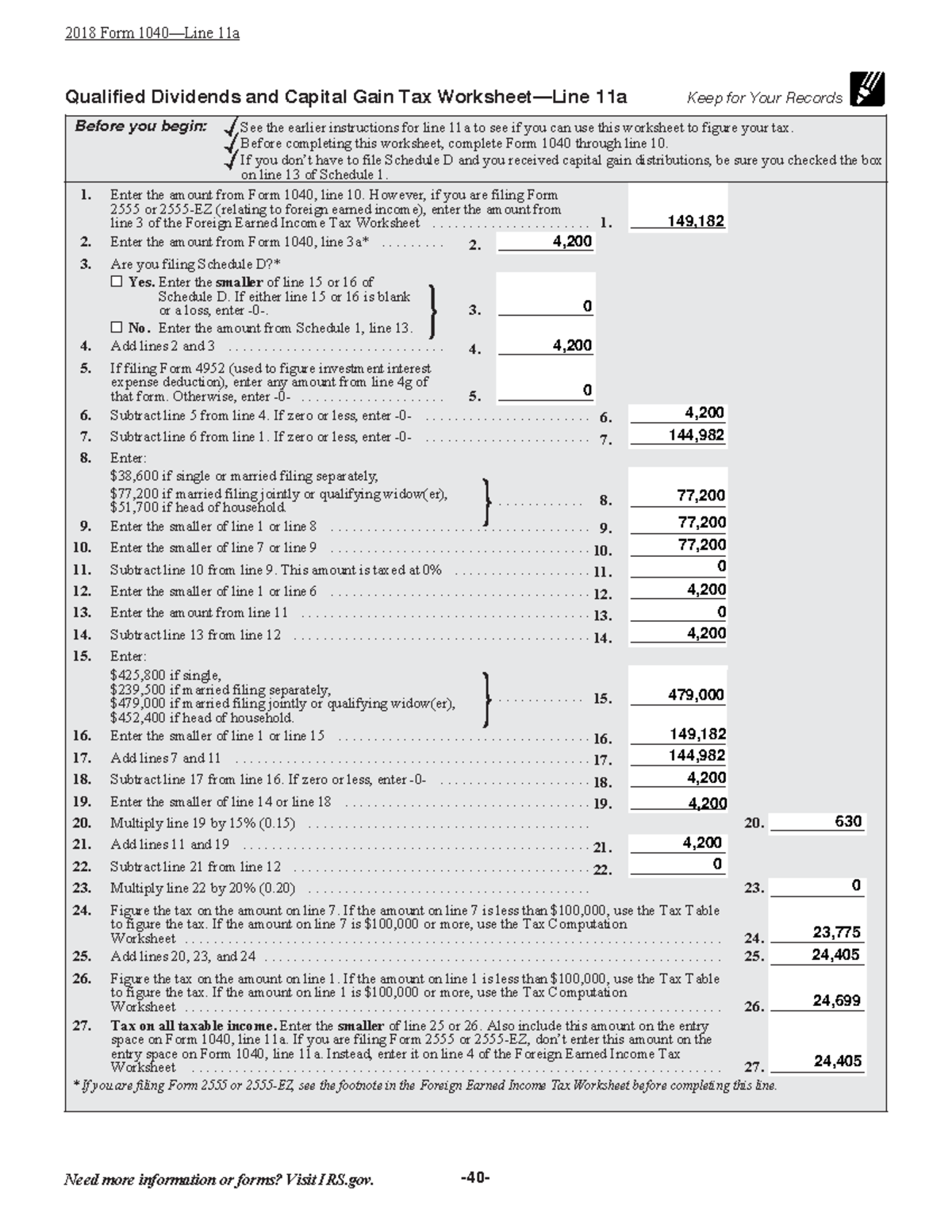

Qualified Dividends Tax Worksheet

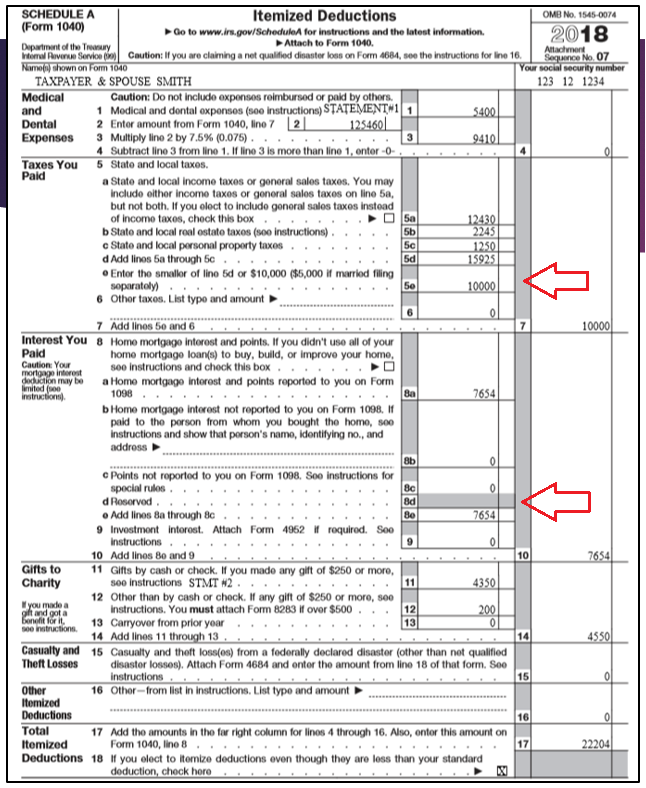

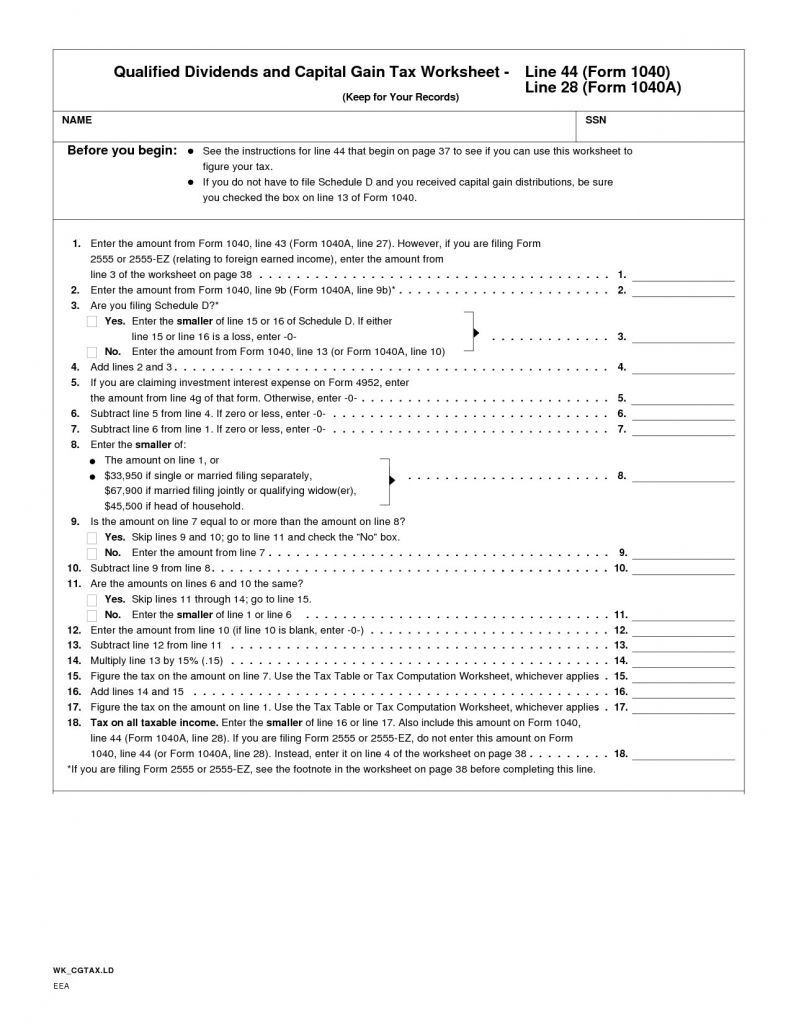

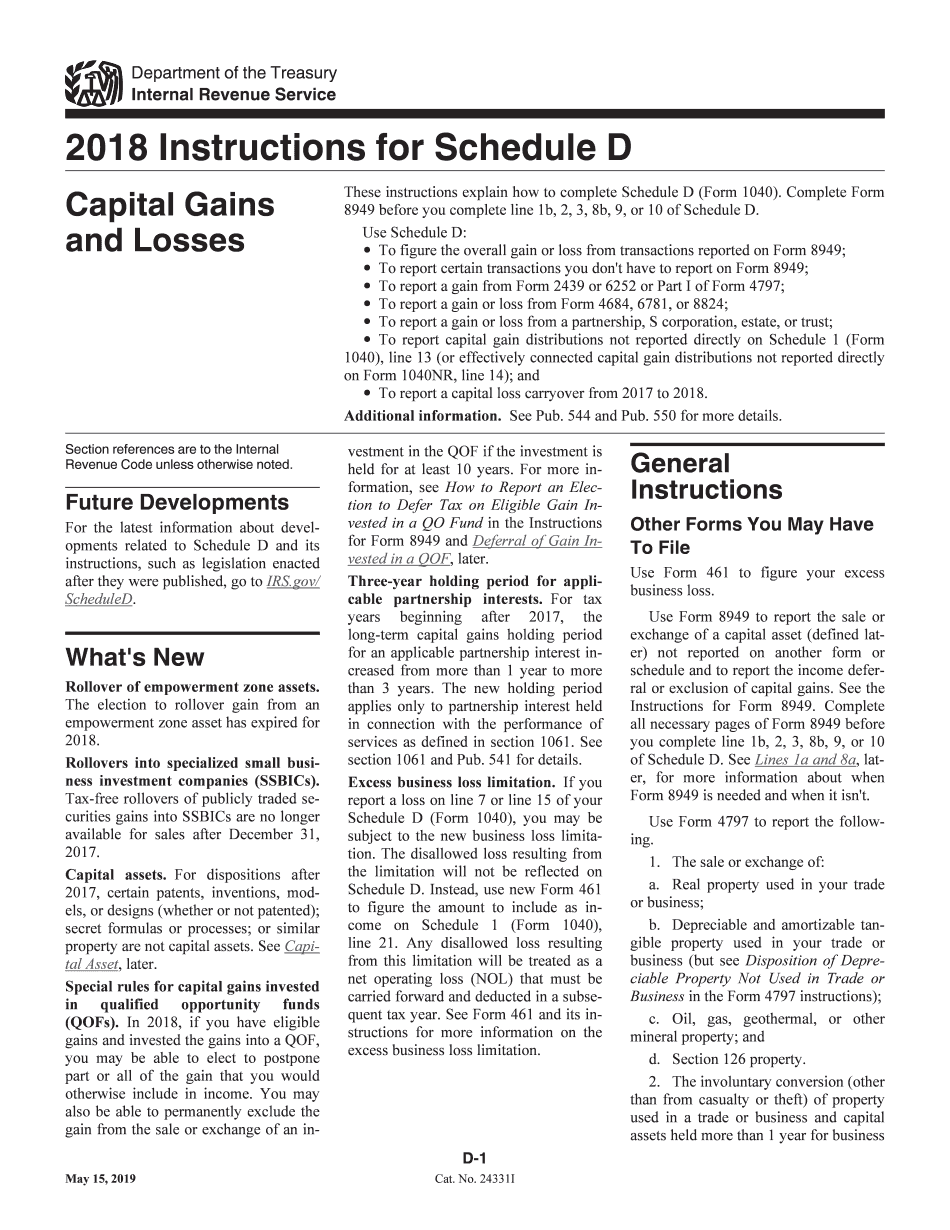

Qualified Dividends Tax Worksheet - Web qualified dividends tax worksheet pdf details. If you have an entry on line 2b(2), be sure. Web capital gains and qualified dividends. (step by step) tax regardless of country and continent, all individuals. Enter the smaller of line 45 or line 46. The 0% and 15% rates. An ordinary or nonqualified dividend gets taxed at the investor's ordinary income tax rate. Web tax on all taxable income (including capital gains and qualified dividends). Web a qualified dividend is eligible for a lower tax rate. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. The 0% and 15% rates. If you have an entry on line 2b(2), be sure. If the amount on line 5 is $100,000 or more, use the tax computation worksheet add lines 18, 21, and 22 figure the tax on the amount on line 1. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040. Web qualified dividends tax worksheet. An ordinary or nonqualified dividend gets taxed at the investor's ordinary income tax rate. If the amount on line 5 is $100,000 or more, use the tax computation worksheet add lines 18, 21, and 22 figure the tax on the amount on line 1. Web it includes taxable interest, dividends, capital gains (including capital gain. If the amount on line 5 is $100,000 or more, use the tax computation worksheet add lines 18, 21, and 22 figure the tax on the amount on line 1. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity income, taxable scholarship and fellowship grants. The 0% and 15% rates. An ordinary. The qualified dividends tax worksheet form. Web to figure the tax. If the amount on line 5 is $100,000 or more, use the tax computation worksheet add lines 18, 21, and 22 figure the tax on the amount on line 1. Web tax on all taxable income (including capital gains and qualified dividends). Web report your qualified dividends on line. Web qualified dividends tax worksheet. The 0% and 15% rates. Enter the smaller of line 45 or line 46. If you have an entry on line 2b(2), be sure. The qualified dividends tax worksheet form. Enter the smaller of line 45 or line 46. Web qualified dividends tax worksheet. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. Web capital gains and qualified dividends. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity income, taxable scholarship and. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. If you have an entry on line 2b(2), be sure. Web you can use the qualified dividends and capital gain tax worksheet found in the instructions for form 1040 to figure out the tax on qualified dividends at. Web to figure. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity income, taxable scholarship and fellowship grants. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. An ordinary or nonqualified dividend gets taxed at the investor's ordinary income tax rate. Web to figure the. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. Web tax on all taxable income (including capital gains and qualified dividends). The qualified dividends tax worksheet form. What is the qualified dividend and capital. Enter the smaller of line 45 or line 46. An ordinary or nonqualified dividend gets taxed at the investor's ordinary income tax rate. Web payments in lieu of dividends, but only if you know or have reason to know that the payments are not qualified dividends. Web in order to figure out how to calculate this tax, it’s best to use the qualified dividend and capital gain tax worksheet.. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity income, taxable scholarship and fellowship grants. The 0% and 15% rates. Web report your qualified dividends on line 9b of form 1040 or 1040a. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. Web qualified dividends tax worksheet pdf details. Enter the smaller of line 45 or line 46. What is the qualified dividend and capital. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. An ordinary or nonqualified dividend gets taxed at the investor's ordinary income tax rate. Web a qualified dividend is eligible for a lower tax rate. The qualified dividends tax worksheet form. If the amount on line 5 is $100,000 or more, use the tax computation worksheet add lines 18, 21, and 22 figure the tax on the amount on line 1. (step by step) tax regardless of country and continent, all individuals. Web tax on all taxable income (including capital gains and qualified dividends). Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard. Web in order to figure out how to calculate this tax, it’s best to use the qualified dividend and capital gain tax worksheet. Web you can use the qualified dividends and capital gain tax worksheet found in the instructions for form 1040 to figure out the tax on qualified dividends at. Web capital gains and qualified dividends. Web payments in lieu of dividends, but only if you know or have reason to know that the payments are not qualified dividends. What is the qualified dividend and capital. Web capital gains and qualified dividends. Web tax on all taxable income (including capital gains and qualified dividends). Web a qualified dividend is eligible for a lower tax rate. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web it includes taxable interest, dividends, capital gains (including capital gain distributions), rents, royalties, pension and annuity income, taxable scholarship and fellowship grants. Web qualified dividends tax worksheet. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the qualified dividends and new rates to the. Web payments in lieu of dividends, but only if you know or have reason to know that the payments are not qualified dividends. If you have an entry on line 2b(2), be sure. The qualified dividends tax worksheet form. Web you can use the qualified dividends and capital gain tax worksheet found in the instructions for form 1040 to figure out the tax on qualified dividends at. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. Web to figure the tax. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. Explore updated credits, deductions, and exemptions, including the standard.Amt Qualified Dividends And Capital Gains Worksheet Ivuyteq

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Irs Qualified Dividends And Capital Gain Tax Worksheet 2019

2017 Qualified Dividends And Capital Gain Tax Worksheet —

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

qualified dividends and capital gain tax worksheet 2019 Fill Online

20++ Qualified Dividends And Capital Gains Worksheet 2020

Understanding The Qualified Dividends And Capital Gains Worksheet 2020

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

ACC 330 61 Final Project Practice Tax Return Qualified Dividends and

If The Amount On Line 5 Is $100,000 Or More, Use The Tax Computation Worksheet Add Lines 18, 21, And 22 Figure The Tax On The Amount On Line 1.

Web Qualified Dividends Tax Worksheet Pdf Details.

An Ordinary Or Nonqualified Dividend Gets Taxed At The Investor's Ordinary Income Tax Rate.

The 0% And 15% Rates.

Related Post: