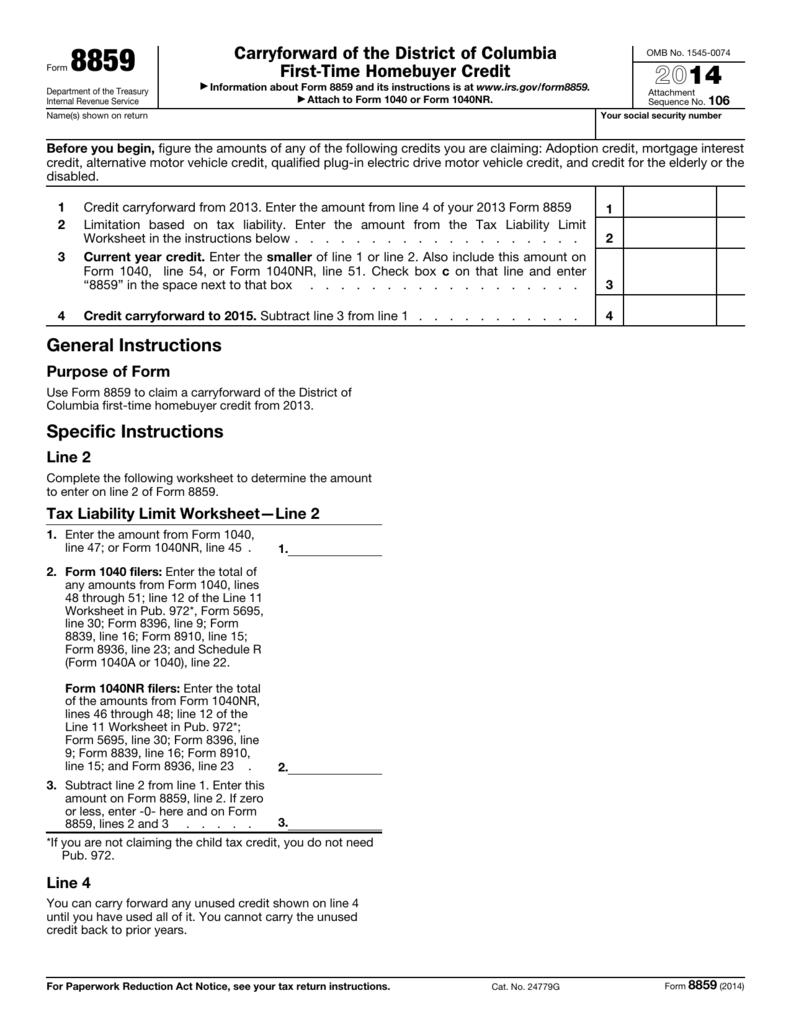

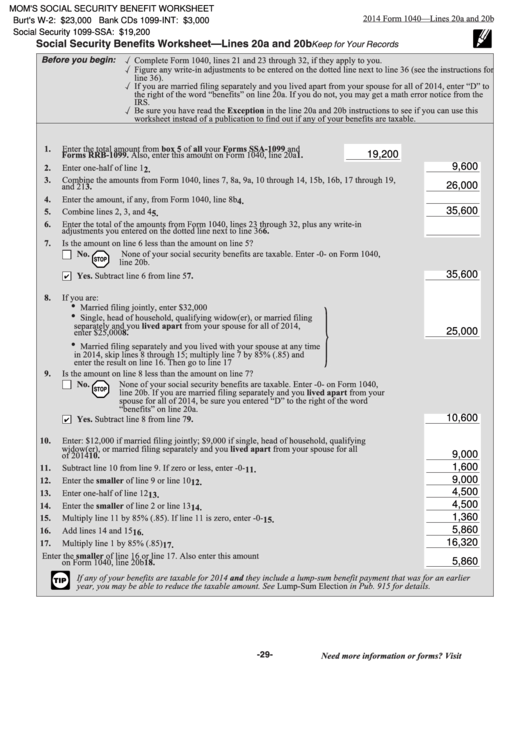

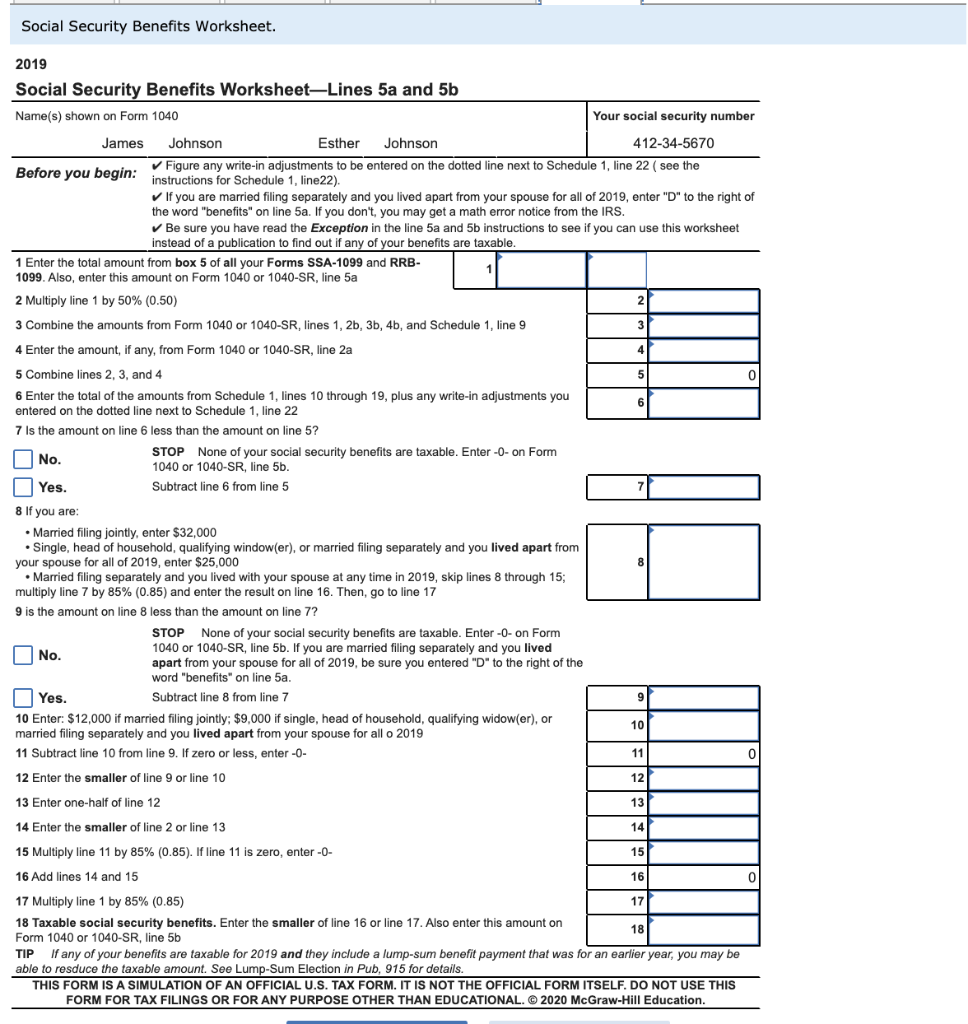

Social Security Worksheet 1040

Social Security Worksheet 1040 - Enter the amount from line 19 of the worksheet here and on part i, line 9. 915 to see if any of your benefits are taxable. Married filing jointly, enter $32,000 single, head of household, qualifying widow(er), or married filing separately and you lived apart from your spouse for all of 2016, enter $25,000 Web if the taxpayer received social security benefits and other income, the social security benefits worksheet found in the form 1040 instructions is completed by the software to calculate the taxable portion. Web social security benefits worksheet (2019) caution: Pdf use our library of forms to quickly fill and sign your irs forms online. Calculating taxable benefits before filling out this worksheet: If a joint return, spouse’s first name and initial. Do not use this worksheet if any of the following apply. Web 2020 social security taxable benefits worksheet keep for your records publication 915 before you begin: Web the social security taxable benets worksheet (2020) form is 1 page long and contains: This worksheet is based on the worksheet in irs publication 915 social security and equivalent railroad retirement benefits. Subtract line 7 from line 6 if you are: Web social security taxable benefits worksheet (2022) worksheet 1. Complete this worksheet to see if any of your. Calculating taxable benefits before filling out this worksheet: Tax return for seniors, including recent updates, related forms and instructions on how to file. Subtract line 7 from line 6 if you are: Web social security benefits worksheet—lines 5a and 5b keep for your records before you begin: See publication 915, social security and equivalent railroad retirement benefits pdf. The social security benefits worksheet is created within turbotax when any social security benefits are entered. Calculating taxable benefits before filling out this worksheet: Tax return for seniors, including recent updates, related forms and instructions on how to file. Modification for taxable social security income worksheet step 1: Web information about notice 703, read this to see if your social. Web expand the federal folder, then expand the worksheets folder. Web social security benefits worksheet (2019) caution: Web social security taxable benefits worksheet (2020) before filling out this worksheet: Web none of your social security benefits are taxable. Web february 21, 2022 8:03 am. Modification for taxable social security income worksheet step 1: 915 to see if any of your benefits are taxable. Web social security taxable benefits worksheet (2022) worksheet 1. If you are using a cd/downloaded version of turbotax, you can view the worksheet using forms mode by clicking forms in the upper right corner of the screen. Web social security benefits. Pdf use our library of forms to quickly fill and sign your irs forms online. Web social security benefits worksheet—lines 5a and 5b keep for your records before you begin: This worksheet is based on the worksheet in irs publication 915 social security and equivalent railroad retirement benefits. Web the form 1040 social security benefits worksheet irs 2018 form is. The worksheet also helps taxpayers determine if they. Modification for taxable social security income worksheet step 1: Web expand the federal folder, then expand the worksheets folder. The social security benefits worksheet is created within turbotax when any social security benefits are entered. Web the form 1040 social security benefits worksheet irs 2018 form is 1 page long and contains: This worksheet is based on the worksheet in irs publication 915 social security and equivalent railroad retirement benefits. Web include any profit or (loss) from part iii, profit or loss from farming, line 36, and/or part iv, profit or loss from business (sole proprietorship), line 27. Tax return for seniors, including recent updates, related forms and instructions on how to. If a joint return, spouse’s first name and initial. Web the social security taxable benets worksheet (2020) form is 1 page long and contains: Web february 21, 2022 8:03 am. The social security benefits worksheet is created within turbotax when any social security benefits are entered. It is used to determine how much of the taxpayer's social security benefits must. Web expand the federal folder, then expand the worksheets folder. Web social security taxable benefits worksheet (2022) worksheet 1. The worksheet also helps taxpayers determine if they. Web the 1040 social security worksheet is a form used to calculate the amount of social security income that is taxable on an individual's federal income tax return. Web if you receive social. Use worksheet 1 in pub. Use the additional child tax credit worksheet in the instructions. Use this worksheet to determine the amount, if any, of your social security modification on schedule m, line 1t. Look for social sec in the forms. Web the form 1040 social security benefits worksheet irs 2018 form is 1 page long and contains: Web expand the federal folder, then expand the worksheets folder. Web none of your social security benefits are taxable. Pdf use our library of forms to quickly fill and sign your irs forms online. Web social security taxable benefits worksheet (2020) before filling out this worksheet: Web name social security number note: The worksheet also helps taxpayers determine if they. Do not use this worksheet if any of the following apply. This worksheet is based on the worksheet in irs publication 915 social security and equivalent railroad retirement benefits. Modification for taxable social security income worksheet step 1: See publication 915, social security and equivalent railroad retirement benefits pdf. Web social security taxable benefits worksheet (2022) worksheet 1. Web if the taxpayer received social security benefits and other income, the social security benefits worksheet found in the form 1040 instructions is completed by the software to calculate the taxable portion. Also, include your taxable social security benefits. It is used to determine how much of the taxpayer's social security benefits must be reported on their federal income tax return. Tax return for seniors, including recent updates, related forms and instructions on how to file. Calculating taxable benefits before filling out this worksheet: Subtract line 7 from line 6 if you are: Web if the taxpayer received social security benefits and other income, the social security benefits worksheet found in the form 1040 instructions is completed by the software to calculate the taxable portion. Web include any profit or (loss) from part iii, profit or loss from farming, line 36, and/or part iv, profit or loss from business (sole proprietorship), line 27. Web name social security number note: • if married filing separately, and taxpayer lived apart from his or her spouse for the entire tax year, enter “d” to the right of This worksheet is based on the worksheet in irs publication 915 social security and equivalent railroad retirement benefits. Enter the amount from line 19 of the worksheet here and on part i, line 9. Web expand the federal folder, then expand the worksheets folder. Modification for taxable social security income worksheet step 1: 915 to see if any of your benefits are taxable. Web jul 27, 2023 11:00 am edt. The social security benefits worksheet is created within turbotax when any social security benefits are entered. Look for social sec in the forms. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. Web the social security taxable benets worksheet (2020) form is 1 page long and contains:Social Security Worksheet For 1040a Nidecmege

Fillable Form 1040 Social Security Benefits Worksheet Lines 20a And

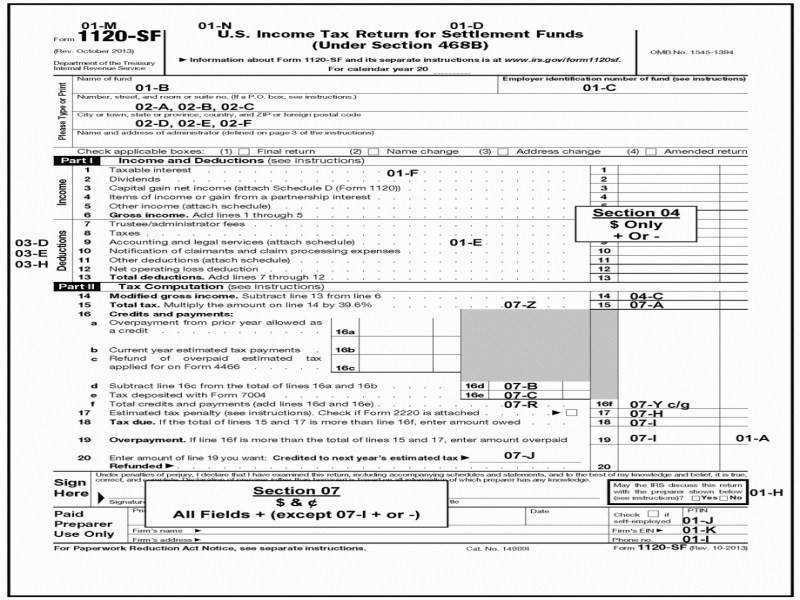

1040x2.pdf Irs Tax Forms Social Security (United States)

IRS Gov Tax Forms SS Worksheet And Pension Worksheet 1040 2021 Tax

Social Security Worksheet For 1040a Nidecmege

Page 1 of Form 1040. Use provided information and

1040ez line 10 instructions

Social Security Benefits Worksheet 2020 Form Printable Jay Sheets

worksheet. Social Security Benefits Worksheet 1040a. Grass Fedjp

Social Security Benefits Worksheet 2020 Instructions Now Jay Sheets

Also, Include Your Taxable Social Security Benefits.

Web Social Security Benefits Worksheet (2019) Caution:

Web Social Security Taxable Benefits Worksheet (2022) Worksheet 1.

Web None Of Your Social Security Benefits Are Taxable.

Related Post: