Tax Deduction Worksheet For Police Officers

Tax Deduction Worksheet For Police Officers - No employee business expenses, including firearms are deductible for a federal tax return. Do not include expenses for which you have been reimbursed, expect to be reimbursed, or are reimbursable. • you must have spent the money yourself and weren’t reimbursed • it must directly relate to earning your income • you must have a record to prove it.* In order for an expense to be deductible, it must be considered an ''ordinary and necessary'' expense. Sign online button or tick the preview image of the form. For 2008/09 onwards, the flat. Police officer tax return and deduction checklist. Fill out the required boxes which are colored in yellow. Enter the amount of your pension that was paid. You may include other applicable expenses. Web for example, a security specialist cannot deduct the expenses of going to a police academy to become a state police officer. Fill out the required boxes which are colored in yellow. Hit the green arrow with the inscription next to jump. Alterations & re boots & shoes d cleanin emblems gauntlets gloves hat & helmet jacket uniforms & u. Enter any additional tax you want withheld each. Income and allowance amounts you need to include in your tax return and amounts you don’t include. We don’t like commuting mileage. Web how to fill out the police officer — tax deduction worksheet — indie barony form on the web: Web tax time if you’re a police officer it pays to. • deductions for unreimbursed employee expenses. Web how to fill out the police officer — tax deduction worksheet — indie barony form on the web: Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web tax time if you’re a police officer it pays to learn what you can claim ato.gov.au/police to claim. If you go with the standard deduction rather than itemize, there's an exception in 2020 due to the pandemic and cares act. • expenses you can't deduct. We don’t like commuting mileage. You can only make this election for amounts that would otherwise be included in your income. You may include other applicable expenses. Alterations & re boots & shoes d cleanin emblems gauntlets gloves hat & helmet jacket uniforms & u airs kee. You can only make this election for amounts that would otherwise be included in your income. Fill out the required boxes which are colored in yellow. Otherwise, the limit for other deductions is usually 50 percent of your agi at. Enter yes to “money was taken out to pay for health insurance”. Web the following tips will allow you to complete tax deduction worksheet for police officers easily and quickly: Hit the green arrow with the inscription next to jump. If you go with the standard deduction rather than itemize, there's an exception in 2020 due to the pandemic and. • you must have spent the money yourself and weren’t reimbursed • it must directly relate to earning your income • you must have a record to prove it.* Enter the amount of your pension that was paid. Therefore all of the following information applies only to a california tax return. No employee business expenses, including firearms are deductible for. The advanced tools of the editor will lead you through the editable pdf template. You can only make this election for amounts that would otherwise be included in your income. Fill out the required boxes which are colored in yellow. Enter yes to “money was taken out to pay for health insurance”. Whether or not an item is listed on. To begin the form, use the fill camp; In order for an expense to be deductible, it must be considered an ''ordinary and necessary'' expense. Web this worksheet provides a way for you to organize your credit and deduction information only. You can only make this election for amounts that would otherwise be included in your income. Web the purpose. Do not include expenses for which you have been reimbursed, expect to be reimbursed, or are reimbursable. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web the internal revenue code provides an exception under irc 3121 (b) (6) (c) from social security and medicare tax for a worker “serving on a temporary. You can only make this election for amounts that would otherwise be included in your income. We don’t like commuting mileage. The advanced tools of the editor will lead you through the editable pdf template. Web to enter the exclusion in your account, go to: Examples of some items you may be able to deduct include: To begin the form, use the fill camp; For 2008/09 onwards, the flat. Web peace officer tax deductions worksheet. • you must have spent the money yourself and weren’t reimbursed • it must directly relate to earning your income • you must have a record to prove it.* • how to report your deductions. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. You may include other applicable expenses. For box 2a, select 'click here for options'. Web tax time if you’re a police officer it pays to learn what you can claim ato.gov.au/police to claim a deduction for work‑related expenses: Alterations & re boots & shoes d cleanin emblems gauntlets gloves hat & helmet jacket uniforms & u airs kee. 4(b) $ (c) extra withholding. Dues paid to professional societies related to your occupation are deductible. Web the internal revenue code provides an exception under irc 3121 (b) (6) (c) from social security and medicare tax for a worker “serving on a temporary basis in case of fire, storm, snow, earthquake, flood, or other similar emergency.” this exception applies only for temporary workers hired in response to an unforeseen emergency. Web the deduction of firearms is very problematic and is one of the most controversial areas in litigation with the franchise tax board. If you go with the standard deduction rather than itemize, there's an exception in 2020 due to the pandemic and cares act. Sign online button or tick the preview image of the form. Alterations & re boots & shoes d cleanin emblems gauntlets gloves hat & helmet jacket uniforms & u airs kee. There are lots of situations that count while others do not. Web tax time if you’re a police officer it pays to learn what you can claim ato.gov.au/police to claim a deduction for work‑related expenses: Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web if needed, turbotax will reduce the deduction to the $3,000 allowed. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter the result here. Enter any additional tax you want withheld each. Otherwise, the limit for other deductions is usually 50 percent of your agi at most. Web to enter the exclusion in your account, go to: • deductions for unreimbursed employee expenses. Web peace officer tax deductions worksheet. Police officer tax return and deduction checklist. Web the following tips will allow you to complete tax deduction worksheet for police officers easily and quickly: Web the deduction of firearms is very problematic and is one of the most controversial areas in litigation with the franchise tax board. Income and allowance amounts you need to include in your tax return and amounts you don’t include.Police Officer Tax Deductions Worksheet —

Tax Deduction Worksheet for Police Officers Fill and Sign Printable

Tax De Trucker Tax Deduction Worksheet Great Linear —

Tax Deductions Law Enforcement Tax Deductions

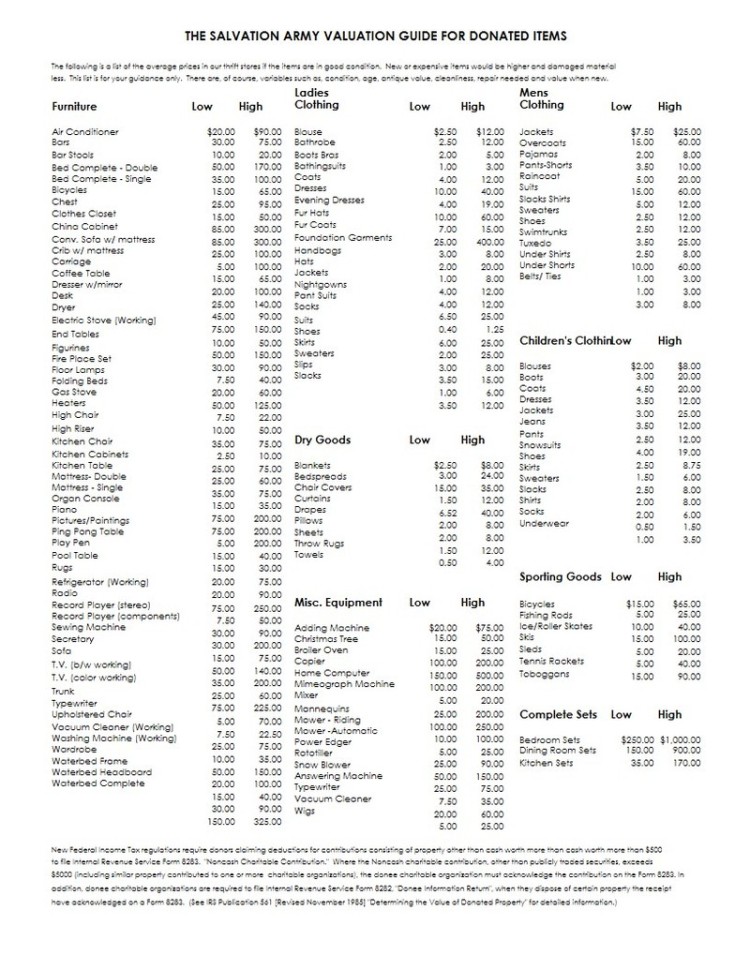

Anchor Tax Service Non cash contribution deduction

Police Officer Tax Deductions Worksheet —

Truck Driver T Trucker Tax Deduction Worksheet Perfect —

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Itemized Tax Deduction Worksheet Oaklandeffect Deductions —

Tax Deduction Worksheet For Police Officers Worksheet Resume Examples

If You Go With The Standard Deduction Rather Than Itemize, There's An Exception In 2020 Due To The Pandemic And Cares Act.

Enter The Information For Your Distribution.

However, The Costs Of Initial Admission Fees Paid For Membership In Certain Organizations Or Social Clubs Are Considered Capital Expenses.

• Expenses You Can't Deduct.

Related Post: