What Is A Schedule C Worksheet

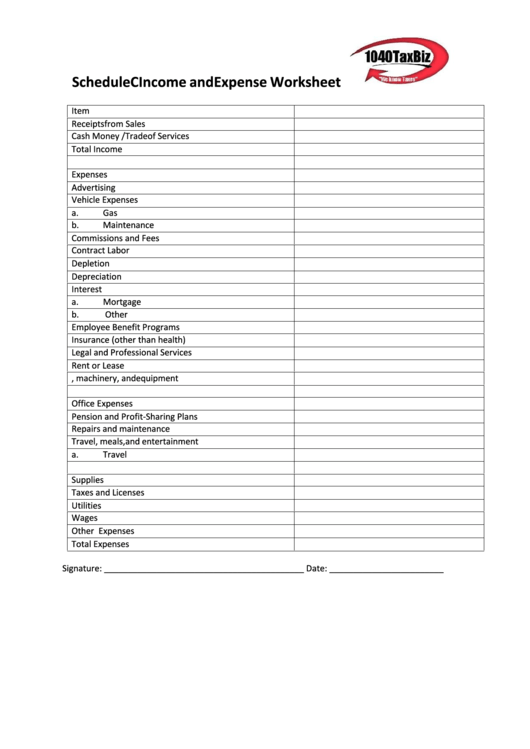

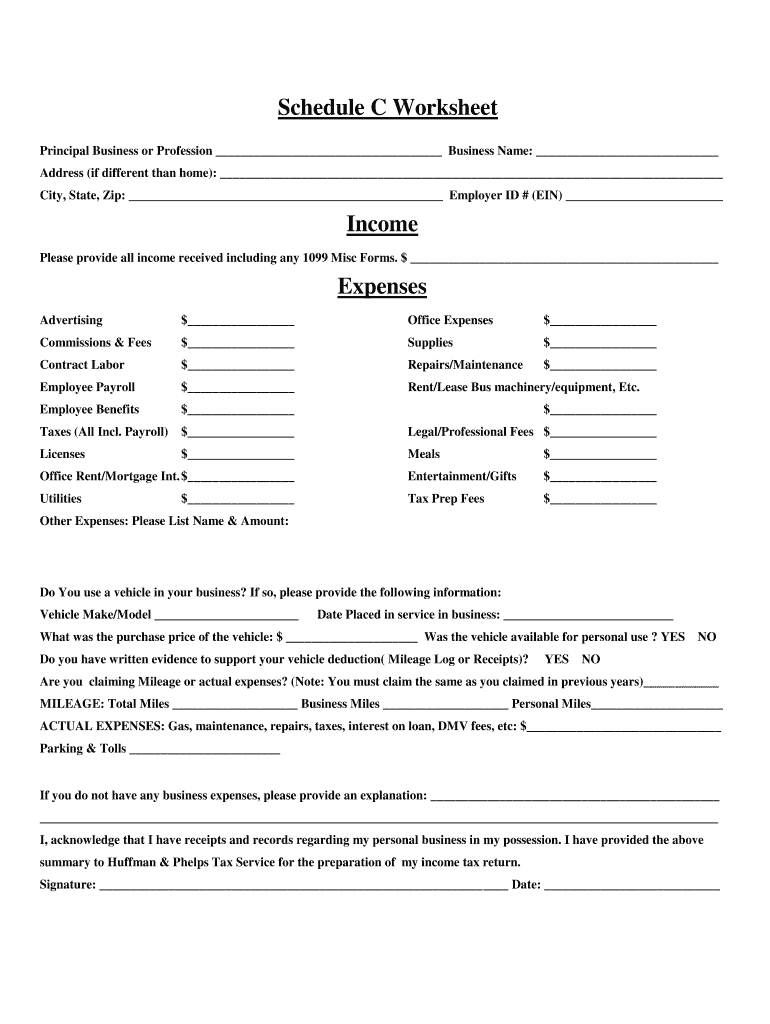

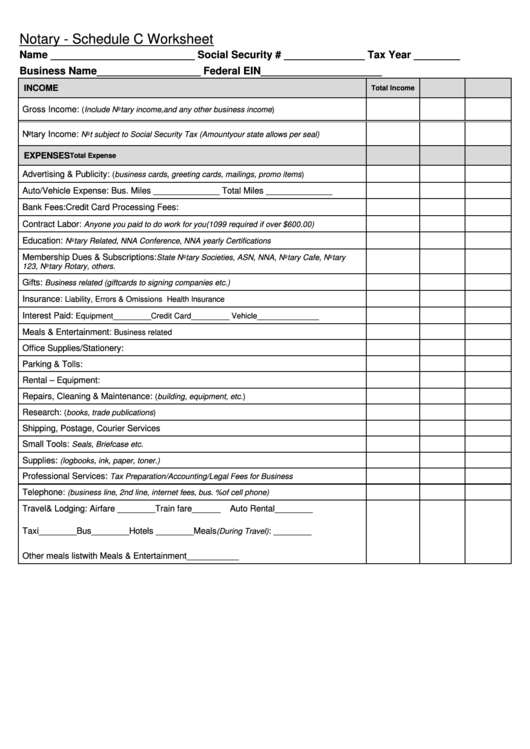

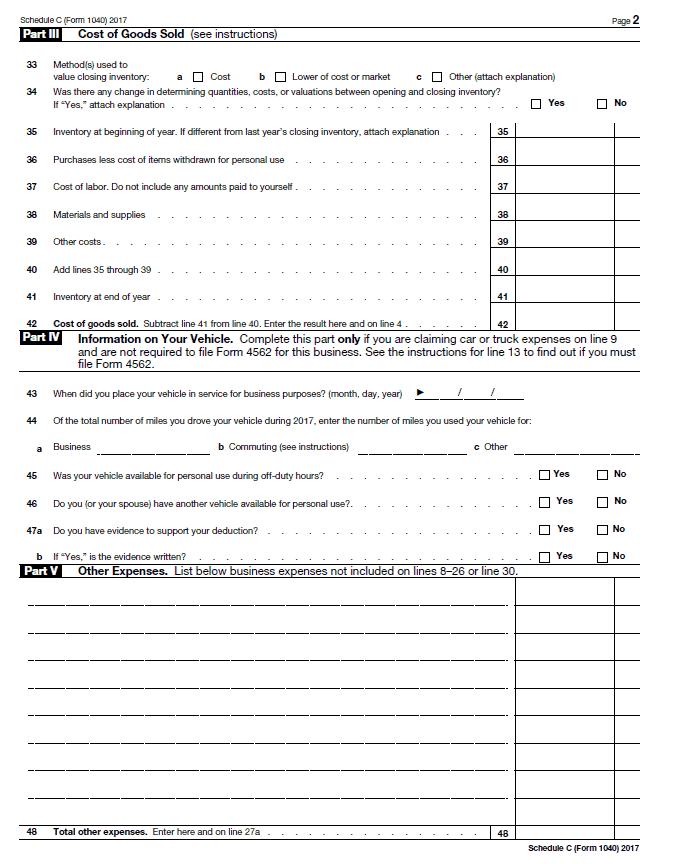

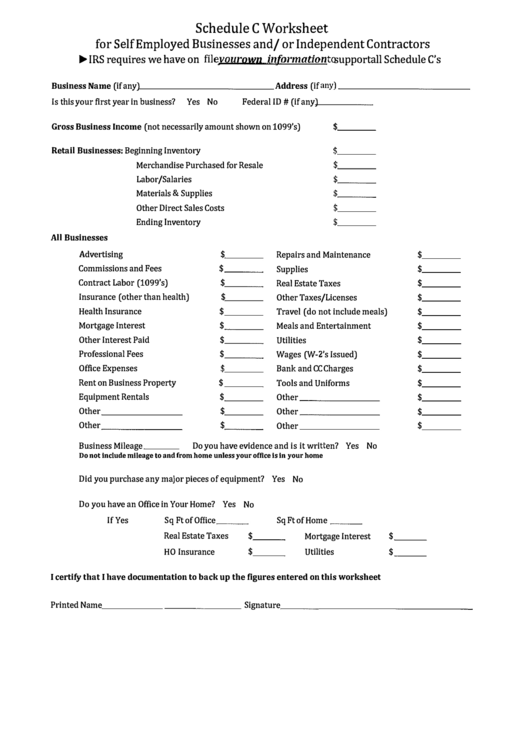

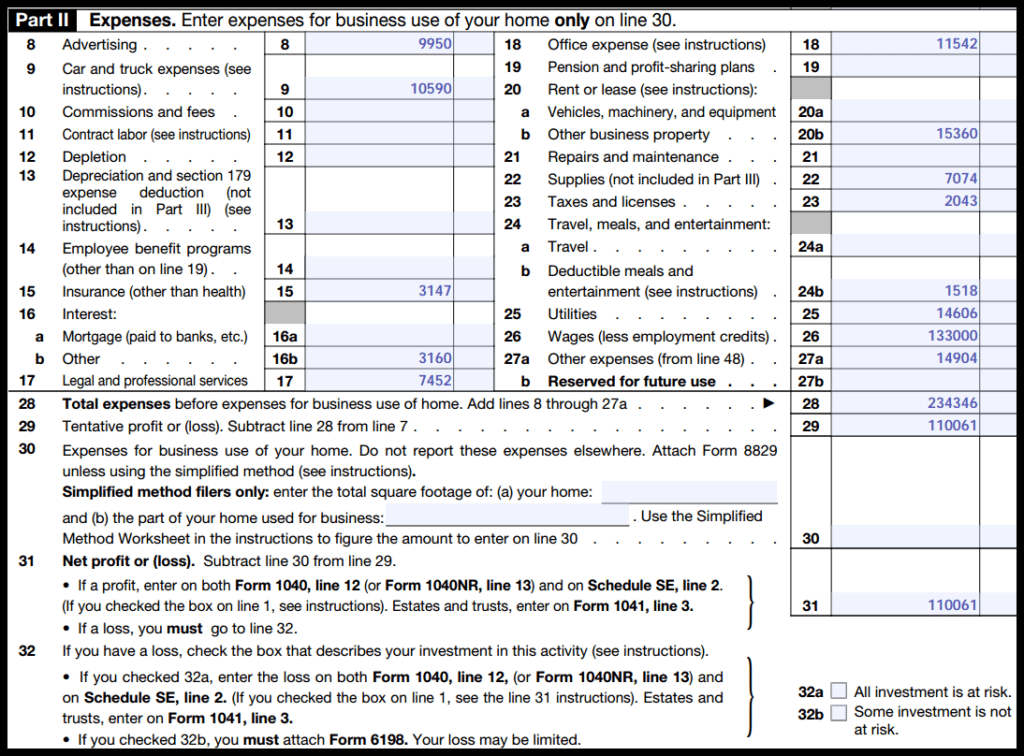

What Is A Schedule C Worksheet - Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Profit or loss from business (form 1040)? An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. It's a calculation worksheet, the profit or loss from business statement. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Web what is schedule c: Your primary purpose for engaging in the activity is for income or profit. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)__________________________________________ address (if any) _________________________________________ Profit or loss from business (sole proprietorship) is used to report how much money you made or lost in a business you operated by yourself. An activity qualifies as a business if: Profit or loss from business (sole proprietorship) is used to report how much money you made or lost in a business you operated by yourself. Profit or loss from business (form 1040)? Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. The form reports how much of the income from your business is subject to tax or whether you have a loss for tax purposes. Web use schedule c (form. Profit or loss from business (form 1040)? Your primary purpose for engaging in the activity is for income or profit. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: It's a calculation worksheet, the profit or loss. Your primary purpose for engaging in the activity is for income or profit. Web irs schedule c is a tax form for reporting profit or loss from a business. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Web use schedule c (form. Web what is schedule c: Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Profit or loss from business (form 1040)? An activity qualifies as a business if: An activity qualifies as a business if your primary purpose for engaging in the activity is. Profit or loss from business (sole proprietorship) is used to report how much money you made or lost in a business you operated by yourself. Your primary purpose for engaging in the activity is for income or profit. It's a calculation worksheet, the profit or loss from business statement. Web use schedule c (form 1040) to report income or (loss). Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)__________________________________________ address (if any) _________________________________________ Web use. Web irs schedule c is a tax form for reporting profit or loss from a business. You fill out schedule c at tax time and attach it to or file it electronically with form 1040. An activity qualifies as a business if: An activity qualifies as a business if your primary purpose for engaging in the activity is for income. Profit or loss from business (sole proprietorship) is used to report how much money you made or lost in a business you operated by yourself. Your primary purpose for engaging in the activity is for income or profit. Profit or loss from business (form 1040)? Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have. The form reports how much of the income from your business is subject to tax or whether you have a loss for tax purposes. An activity qualifies as a business if: It's a calculation worksheet, the profit or loss from business statement. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)__________________________________________ address (if any) _________________________________________ It's a calculation worksheet, the profit or loss from business statement. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Profit or loss from business (form 1040)? Profit or loss from business (sole proprietorship) is used to report how much money you made or lost in a business you operated by yourself. An activity qualifies as a business if: Web what is schedule c: Web irs schedule c is a tax form for reporting profit or loss from a business. You fill out schedule c at tax time and attach it to or file it electronically with form 1040. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. The form reports how much of the income from your business is subject to tax or whether you have a loss for tax purposes. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Your primary purpose for engaging in the activity is for income or profit. An activity qualifies as a business if: Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Profit or loss from business (form 1040)? Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)__________________________________________ address (if any) _________________________________________ Profit or loss from business (sole proprietorship) is used to report how much money you made or lost in a business you operated by yourself. Your primary purpose for engaging in the activity is for income or profit. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Web irs schedule c is a tax form for reporting profit or loss from a business. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. The form reports how much of the income from your business is subject to tax or whether you have a loss for tax purposes.Schedule C And Expense Worksheet printable pdf download

Printable Schedule C Worksheet

Schedule C Worksheet Form Fill Out and Sign Printable PDF Template

Schedule C Worksheet printable pdf download

Schedule C Form 1040 How to Complete it? The Usual Stuff

schedule c worksheet fillable

Fillable Schedule C Worksheet For Self Employed Businesses And/or

Schedule C Worksheet —

Form 1040 Schedule C Line 9 2021 Tax Forms 1040 Printable

schedule c worksheet excel

Web What Is Schedule C:

You Fill Out Schedule C At Tax Time And Attach It To Or File It Electronically With Form 1040.

It's A Calculation Worksheet, The Profit Or Loss From Business Statement.

Related Post: