Credit Card Comparison Worksheet Answers

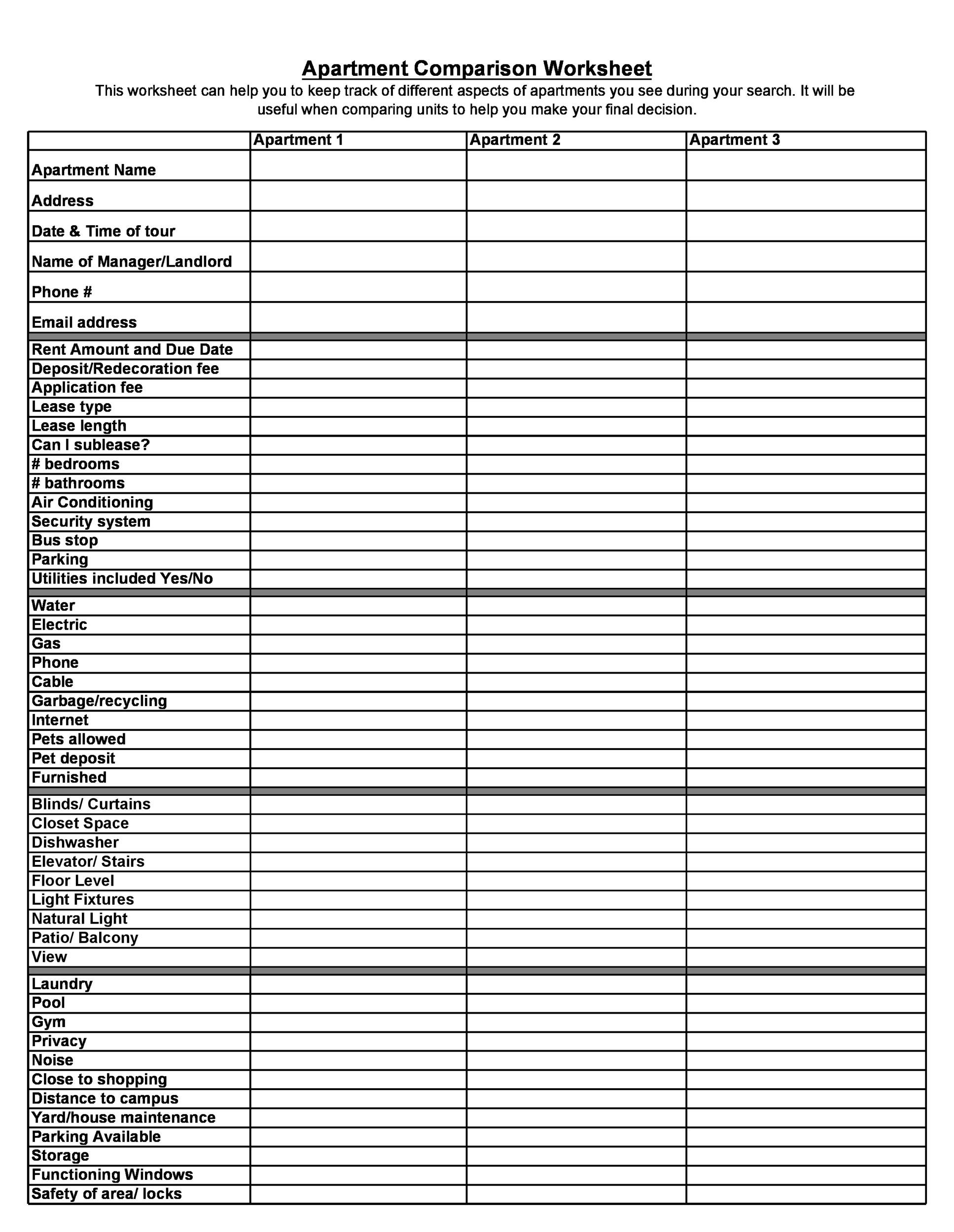

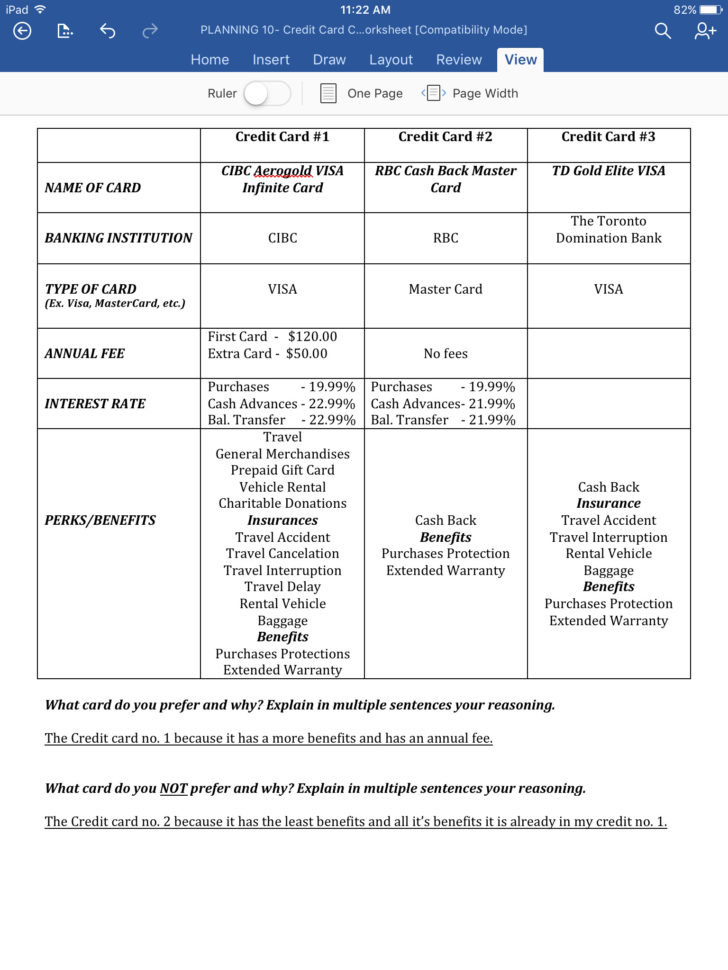

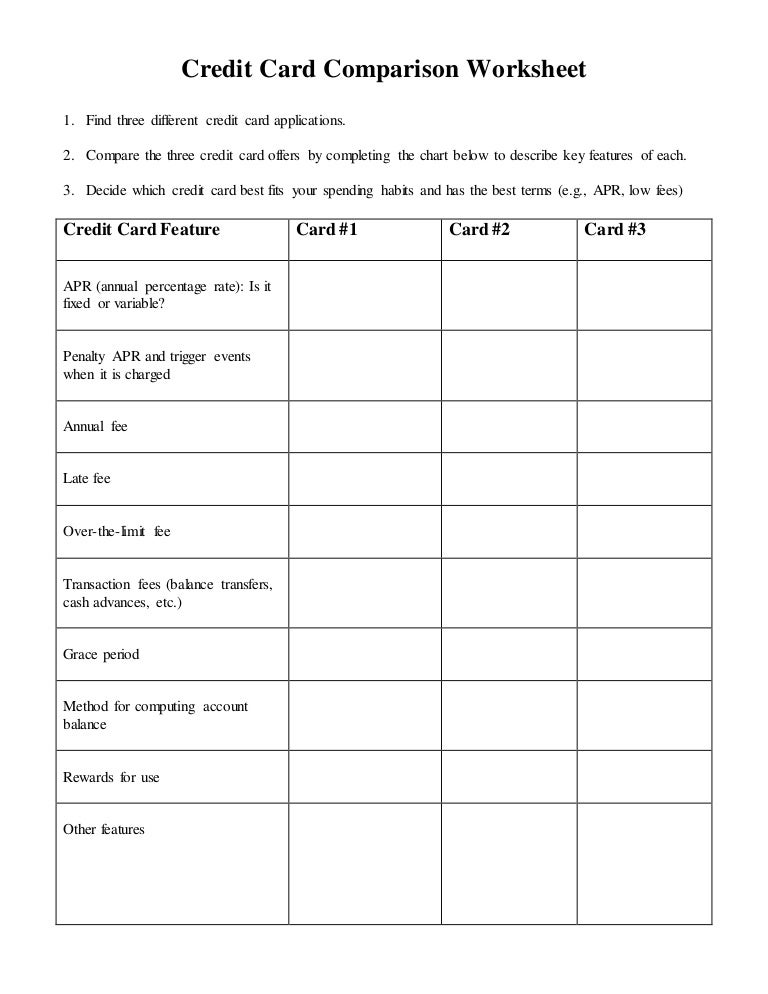

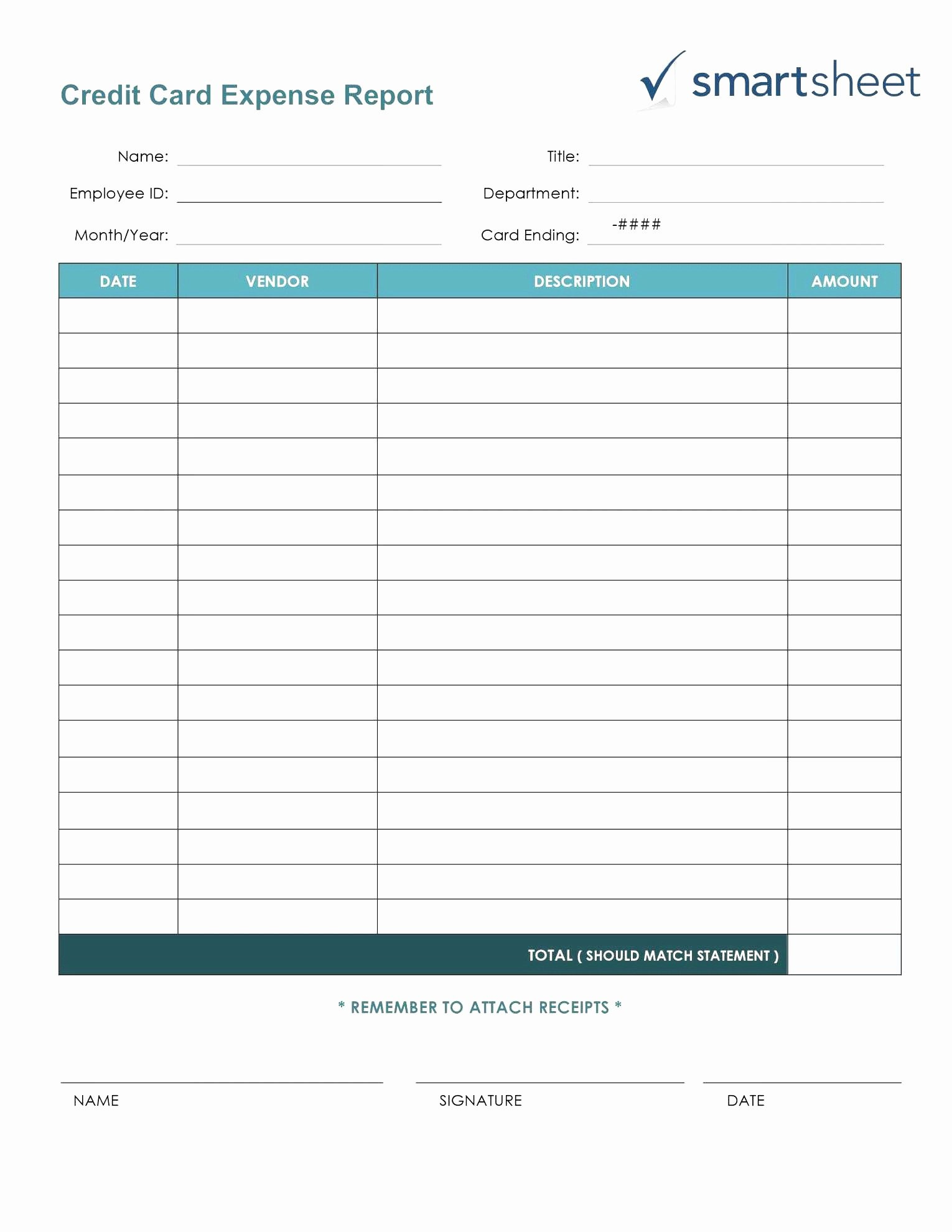

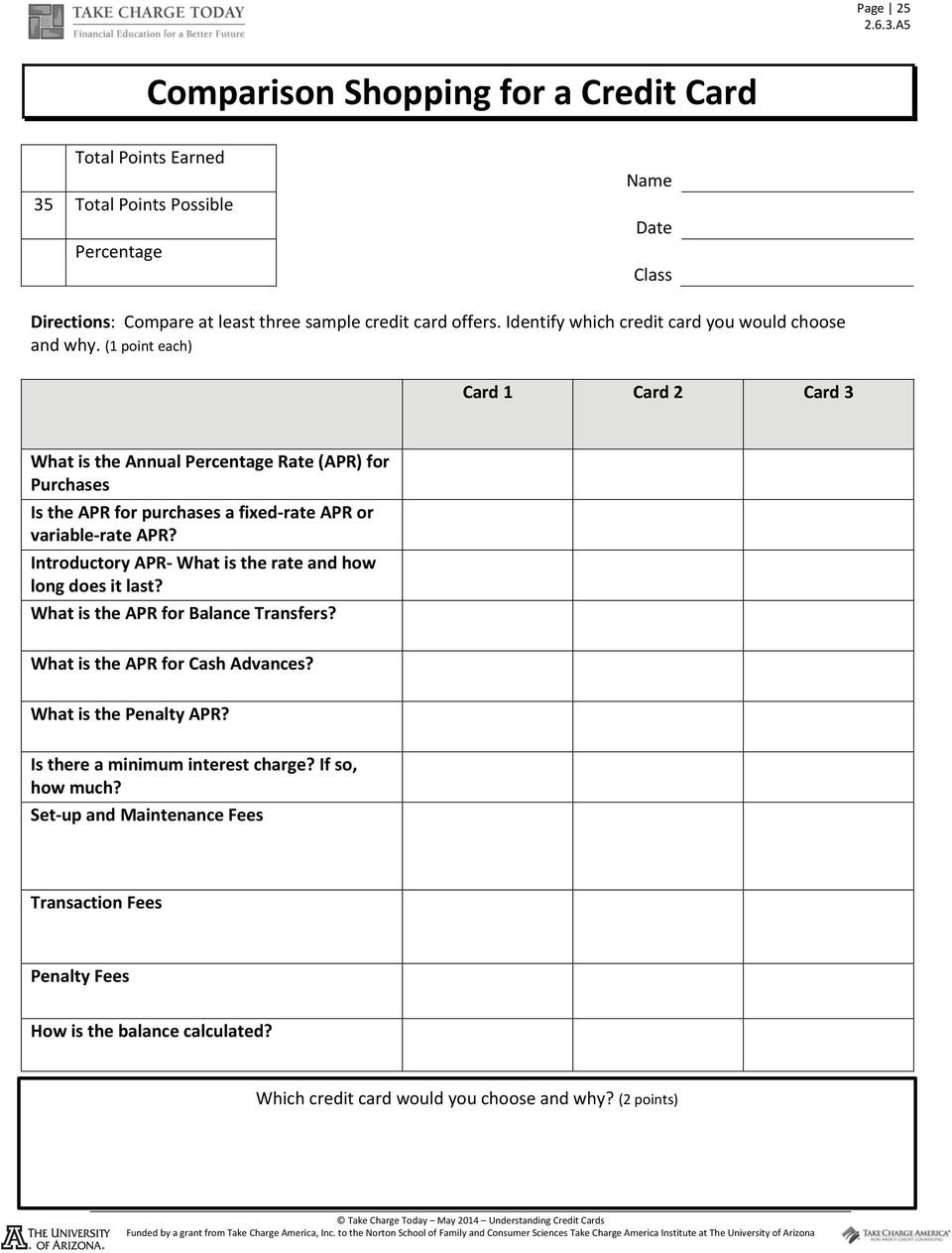

Credit Card Comparison Worksheet Answers - Web google doc worksheet to compare debit and credit cards. Waived card fees on top rewards credit cards. Web credit card comparison shopping worksheet things to consider when choosing a credit card: At an interest rate of 10%, a borrower would pay $110 for $100. The fee, expressed as a percentage, a borrower owes for the use of a creditor's money. How many of you have a credit card? A higher credit limit allows more use of the card, but higher credit balances can negatively affect credit scores. Web check out these fun worksheets to help you instruct your students nearly credit additionally how go compare credit cards. Ad review our top credit card picks for active duty military members. What is the balance on the credit card as of 12/30/xx? A higher credit limit allows more use of the card, but higher credit balances can negatively affect credit scores. This can be done with a partner to compare credit cards. Introduce the lesson’s focus on credit cards. Web charged to the card. If you're going to pay the bill in full every month, then the interest rate doesn't really. Fees are usually charged for going over the. Which credit option appeals to you most? At an interest rate of 10%, a borrower would pay $110 for $100. Which credit card has the highest annual percentage rate and how much is it? Compare at least three sample credit card. Ad review our top credit card picks for active duty military members. Fees are usually charged for going over the. Exclusive benefit for active military: Web up to $40 cash back name date credit card comparison evaluate different credit card applications comparing finance charges, interest, late fees, closing costs, annual fees,. A higher credit limit allows more use of the. Credit limit amount secured/regular/premium card feature: At an interest rate of 10%, a borrower would pay $110 for $100. How many of you have a credit card? Prepare a chart showing how the finance charge is calculated, the interest rate, annual fee, and minimum. If you're going to pay the bill in full every month, then the interest rate doesn't. Web fill out each fillable field. Introduce the lesson’s focus on credit cards. What is the minimum payment on this credit card statement? Exclusive benefit for active military: Web find three credit card offers and compare the offers. If you're going to pay the bill in full every month, then the interest rate doesn't really. Exclusive benefit for active military: The fee, expressed as a percentage, a borrower owes for the use of a creditor's money. Which credit card has the highest annual percentage rate and how much is it? Web google doc worksheet to compare debit and. Exclusive benefit for active military: The fee, expressed as a percentage, a borrower owes for the use of a creditor's money. If no students have credit cards, ask whether they know. Comparecredit.com has been visited by 100k+ users in the past month Web fill out each fillable field. Use the application you brought to class plus 2 additional applications from creditcards to. Exclusive benefit for active military: Which credit option appeals to you most? What is the balance on the credit card as of 12/30/xx? What is a minimum payment? If you're going to pay the bill in full every month, then the interest rate doesn't really. Ad review our top credit card picks for active duty military members. What method is used to calculate the monthly finance charge for the first major credit card? Introduce the lesson’s focus on credit cards. Web comparison shopping for a credit card total. Web comparison shopping for a credit card total points earned name 35 total points possible date percentage class directions: Web credit card comparison shopping worksheet things to consider when choosing a credit card: Credit limit amount secured/regular/premium card feature: A higher credit limit allows more use of the card, but higher credit balances can negatively affect credit scores. What is. Prepare a chart showing how the finance charge is calculated, the interest rate, annual fee, and minimum. Waived card fees on top rewards credit cards. What method is used to calculate the monthly finance charge for the first major credit card? At an interest rate of 10%, a borrower would pay $110 for $100. Web describe how credit cards work and the types of fees that they may have • describe how secured credit cards work • explain how loans work and how they differ from credit. How many of you have a credit card? Web fill out each fillable field. This can be done with a partner to compare credit cards. Web charged to the card. Web credit card comparison shopping worksheet things to consider when choosing a credit card: Web comparison shopping for a credit card total points earned name 35 total points possible date percentage class directions: Which piece of information (annual fees, apr, other) would you pay more attention to? Web develop skills to compare and evaluate the terms and conditions of various credit cards, the differences between credit cards, and the legal and financial responsibilities involved. The fee, expressed as a percentage, a borrower owes for the use of a creditor's money. Compare at least three sample credit card. Credit limit amount secured/regular/premium card feature: Which credit option appeals to you most? Ad review our top credit card picks for active duty military members. Web up to $40 cash back name date credit card comparison evaluate different credit card applications comparing finance charges, interest, late fees, closing costs, annual fees,. Web google doc worksheet to compare debit and credit cards. Web charged to the card. Ad review our top credit card picks for active duty military members. Fees are usually charged for going over the. At an interest rate of 10%, a borrower would pay $110 for $100. Which credit option appeals to you most? If you're going to pay the bill in full every month, then the interest rate doesn't really. Web describe how credit cards work and the types of fees that they may have • describe how secured credit cards work • explain how loans work and how they differ from credit. Prepare a chart showing how the finance charge is calculated, the interest rate, annual fee, and minimum. Introduce the lesson’s focus on credit cards. Comparecredit.com has been visited by 100k+ users in the past month What is a minimum payment? Web up to $40 cash back name date credit card comparison evaluate different credit card applications comparing finance charges, interest, late fees, closing costs, annual fees,. This can be done with a partner to compare credit cards. Web google doc worksheet to compare debit and credit cards. Exclusive benefit for active military: Web credit card comparison shopping worksheet things to consider when choosing a credit card:34 Credit Card Comparison Worksheet support worksheet

Credit Card Comparison Worksheet Yooob —

Credit Card Comparison Worksheet

️Checking Account Comparison Worksheet Free Download Gmbar.co

The Secret History Of The Credit Card Worksheet Answers

34 Credit Card Comparison Worksheet support worksheet

Caroline Blue's Credit Report Worksheet Answers Alphabet Worksheets

️Bank Account Comparison Worksheet Answers Free Download Gmbar.co

️Bank Account Comparison Worksheet Answers Free Download Gambr.co

The Secret History Of The Credit Card Worksheet Answers

Web Check Out These Fun Worksheets To Help You Instruct Your Students Nearly Credit Additionally How Go Compare Credit Cards.

What Is The Minimum Payment On This Credit Card Statement?

Which Piece Of Information (Annual Fees, Apr, Other) Would You Pay More Attention To?

The Fee, Expressed As A Percentage, A Borrower Owes For The Use Of A Creditor's Money.

Related Post: